Driven by the growth of downstream power battery shipments, China’s shipments of anode materials in 2020 will be 365,000 tons, a year-on-year increase of 37.7%, and a compound growth rate of 38.0% in the past five years.

At present, the shipments of negative electrode materials are mainly based on graphitized carbon materials.

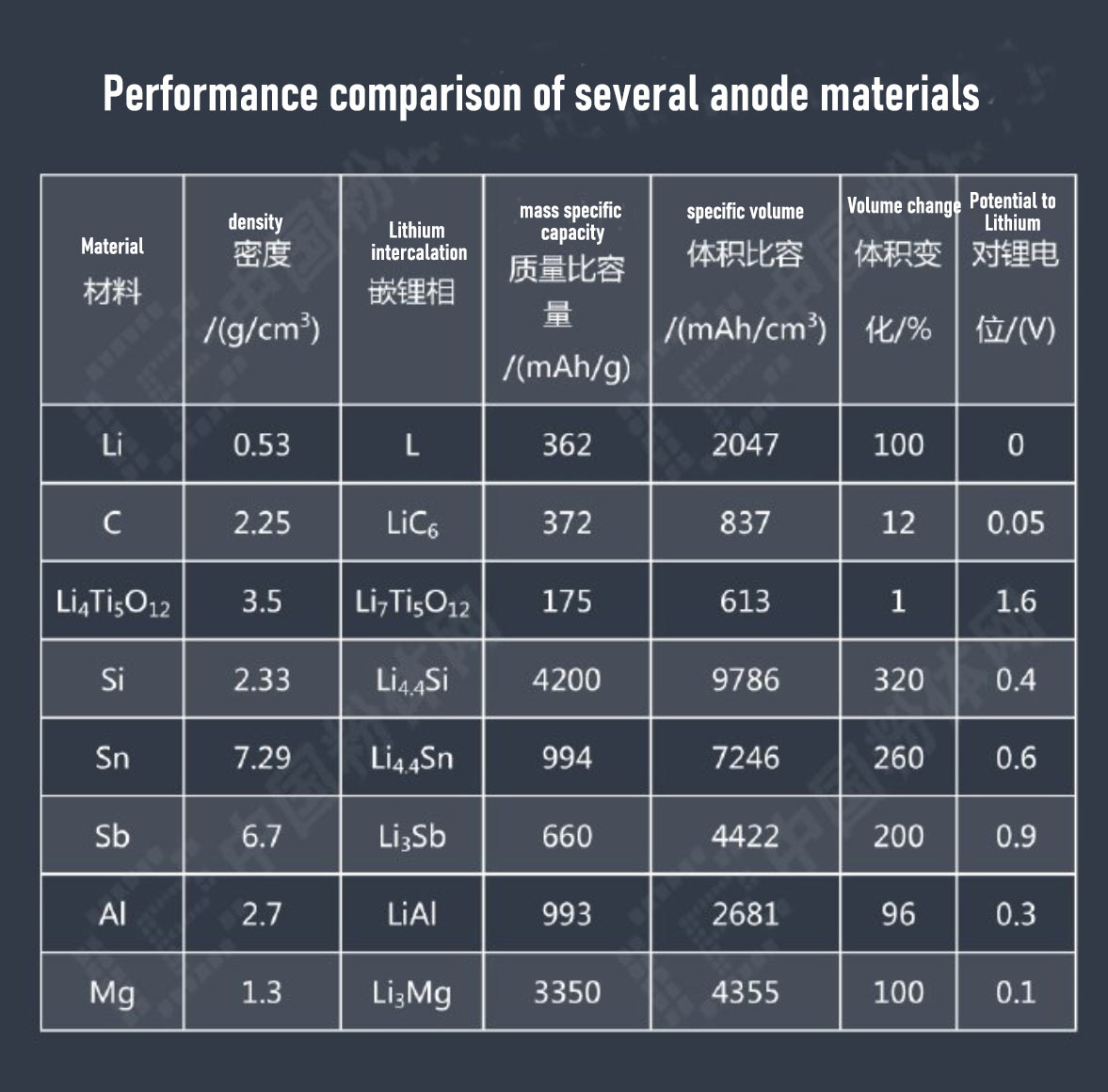

Graphite is currently the most widely used negative electrode material for lithium-ion batteries, and its actual specific capacity is close to the theoretical specific capacity limit of 372 mAh/g. There is limited room for further improvement, and it is not enough to meet the high energy density requirements of future power batteries.

The silicon-based anode material has a huge advantage over the graphite anode in terms of specific capacity. The theoretical specific capacity is as high as 4200 mAh/g, which is about 10 times that of the graphite anode. At the same time, it has a low lithium deintercalation potential (~0.4V, slightly higher than that of graphite), which can avoid the phenomenon of lithium precipitation on the surface during charging, and its safety performance is better than that of graphite anode materials.

However, the current silicon carbon anode process is still immature, and the problems such as low efficiency and volume expansion in the first week cannot be solved, and the requirements for mass production have not yet been met. At present, enterprises mostly use a small amount of silicon-carbon material in the graphite anode material for modification.

With the increasing energy density requirements of power batteries, silicon carbon anodes are expected to become the most promising next-generation anode materials, and the system with high nickel ternary materials is expected to become a development trend.

From the perspective of the market structure, the main domestic manufacturers of silicon-based anode materials include Betray, Shanghai Shanshan, Jiangxi Zichen, Jiangxi Zhengtuo, Zhongke Electric, Shenzhen Snow, etc. Among them, there are few enterprises that can achieve mass production.

Betri has a first-mover advantage in silicon-carbon composite anode materials. In 2013, it passed the certification of Samsung Electronics in South Korea and started mass production and supply. At present, it has entered the Panasonic-Tesla supply chain to achieve large-scale supply.

Jiangxi Zichen plans to invest 5 billion yuan to build diaphragm, anode materials and other projects in Liyang, Jiangsu. This project includes mass production of new silicon-carbon composite anode materials. The company’s silicon carbon anode series materials have a specific capacity ranging from 380-900mAh·g-1.

Shanghai Shanshan has a monthly ton-level shipment scale, and is expected to complete a 4,000-ton/year silicon carbon anode production scale. Its silicon carbon anode products have been mass-produced and supplied, but the shipments are not large, and the main customer is CATL.