Following the announcement on August 19, 2021 of the strategic cooperation with Ningde Times to jointly develop new materials to improve battery performance, Silicon Treasure Technology (300019.SZ) has made further arrangements in the field of lithium batteries. The company will invest 560 million yuan in Pengshan Economic Development in Sichuan. The district established a wholly-owned subsidiary, Sibao Technology (Meishan) New Energy Technology Co., Ltd., to build a 10,000-ton/year silicon-carbon anode material for lithium batteries, a 40,000-ton/year special adhesive production base, and a lithium battery material research and development center.

A relevant person from the company told the Financial Associated Press that because of its large specific capacity, silicon carbon anode material can greatly improve the energy density of lithium batteries, and it is the development direction of a new generation of anode materials. The company is optimistic about the prospects of this industry. The project is constructed in two phases. After the shareholders’ meeting, the company will sign the “Industrial Project Investment Agreement” with the Pengshan Economic and Technological Development Zone Management Committee, and immediately start the preliminary work such as land acquisition, EIA, and design to accelerate the progress and seize the market. It is expected that the construction can be officially started after half a year. The first phase of the project is expected to be completed and put into operation within 30 months, and the second phase will be completed and put into operation within 12 months after the completion of the first phase of the project.

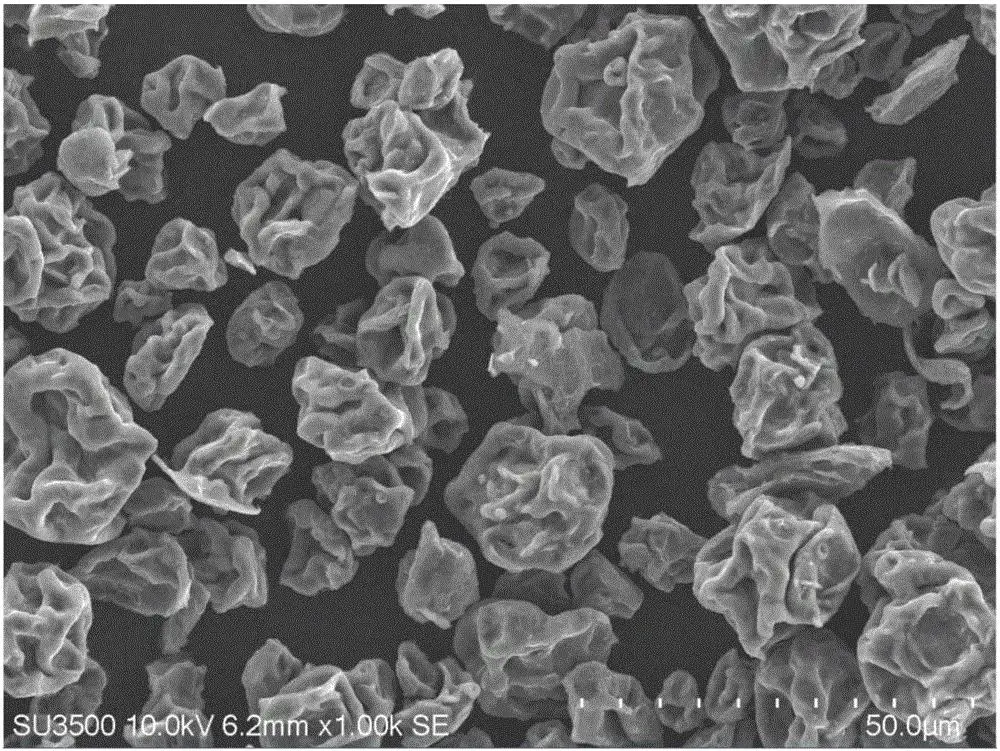

The reporter learned from analysts that silicon carbon anode, as a new type of lithium-ion battery anode material, is more efficient than the current graphite anode in improving battery energy density, but the cost is also higher, and it is still in the early stage of commercialization.

Abroad, Tesla has applied silicon carbon anode to Model 3, adding 10% silicon to artificial graphite, the anode capacity has been increased to 550mAh/g, and the monomer energy density has reached 300Wh/kg; the silicon base of Japan GS Yuasa Company Negative electrodes have been successfully used in Mitsubishi cars. At the earliest stage in China, the only mass-producing manufacturer currently has Betray, which has a production capacity of 3,000 tons/year and is mainly supplied to Panasonic; Shi Dashenghua’s 1,000-ton/year silicon-carbon anode material production facility has passed the completion acceptance, and will be tested in the future. Production; the rest such as Xiangfenghua, Shanshan Co., Ltd., Putailai, Silicon Treasure Technology, etc. are in the pilot stage, and more companies are in the technology reserve stage.

Silicon Treasure Technology is mainly engaged in the research and development, production and sales of new materials such as silicone sealants. The main products include silicone sealants and silane coupling agents. The announcement stated that since 2016, the company has cooperated with Chengdu Institute of Organic Chemistry, Chinese Academy of Sciences, Sichuan University, University of Electronic Science and Technology of China and other colleges and universities to carry out research and development of silicon carbon anodes for lithium batteries and other related materials. In 2019, the company built 50 tons of silicon carbon per year. The pilot production line of negative electrode materials has technical accumulation.

According to the above-mentioned company sources, as of 2020, the company has invested more than 20 million yuan to establish a lithium battery material research and development center, and has a number of senior research and development personnel in the industry. In 2019, the company’s silicon carbon anode material products have passed the Sichuan Provincial Economic and Information Department. , the appraisal result is at the international advanced level, and it has passed the evaluation of several battery manufacturers and achieved small batch supply. However, at present, the contribution to the performance is very small, and industrialized scale production is urgently needed.

As for the source of funds, the explanation is mainly self-funded or self-raised funds. “The capital investment is not a one-off, so the company will gradually invest according to the progress. The company made a fixed increase last year, of which 240 million supplemented working capital. If the funds are insufficient in the future, it is not ruled out through fixed increase, bond issuance or bank loans and other financing methods to solve the problem. .”

As for the follow-up sales issue, the above-mentioned company people are more optimistic, saying that the company has realized the supply of adhesives to BYD, LONGi, ZTE, Ganfeng Lithium and other companies, and has many years of adhesive application in new energy, lithium batteries, electronic appliances and other industries channel accumulation. According to the announcement, the investment rate of return (after tax) of the project is expected to be 23.05%, and the investment recovery period (static, including construction period of 42 months) is 6.52 years.